extended child tax credit 2021

300 per month for each qualifying. Enter your information on Schedule 8812 Form.

Why Opting Out Of Monthly Child Tax Credit Payments May Work For Some Families Boyer Ritter Llc

It raised the amount of money for the CTC and sent advance payments to families in 2021.

. The IRS plans to begin sending monthly payments from the new 3000 child tax credit in July Commissioner Charles Rettig said Tuesday during a hearing. What Is the Expanded Child Tax Credit. Prior to 2021 the child tax credit provided families with kids ages 0 to 16 with up to 2000 per qualifying dependent.

What is the expanded Child Tax Credit. Prior to 2021 the Child Tax Credit maxed out at 2000 per child. The American Rescue Plan increased the amount of the Child Tax Credit CTC made it available for 17-year-old dependents made it fully refundable for most families and made it possible for families to receive up to half of it in advance in monthly payments during the last half of 2021.

The United States federal child tax credit CTC is a partially-refundable tax credit for parents with dependent childrenIt provides 2000 in tax relief per qualifying child with up to 1400 of that refundable subject to an earned income threshold and phase-in. A recent study published by the Urban Institute shows that if the child tax credit is extended beyond 2021 it could substantially reduce child poverty in. For additional information on the amounts of modified AGI that reduce the 2021 Child Tax Credit see Q C4 and Q C5 below.

Previously the credit was 2000 per child under 17 and will revert back to that if the temporary changes put in place for 2021 are not extended. In a move that could benefit many families House Democrats passed the 175 trillion Build Back Better Act Friday which includes a one-year extension of the enhanced child tax credit CTC. The child and dependent tax credit was introduced in 1997 as part of the Taxpayer Relief Act.

250 per month for each qualifying child age 6 to 17 at the end of 2021. Ad Discover trends and view interactive analysis of child care and early education in the US. In 2021 Congress passed the American Rescue Plan which expanded the child tax credit for most American families increasing the amount to 3600 per child under 6 and 3000 for kids 6 to 17.

Most recently lawmakers proposed extending the child tax credit to just one year in an effort to trim the cost of President Joe Bidens 35 trillion plan. Expanded Child Tax Credit for 2021. The American Rescue Plan signed into law earlier this year enhanced the 2021 child tax credit increasing its maximum value making it fully refundable and expanding eligibility.

Included in President Joe Bidens American Rescue Plan the 19tn coronavirus relief package is an extended child tax credit for qualifying families. The maximum credit amount has increased to 3000 per qualifying child between ages 6 and 17 and 3600 per qualifying child under age 6. In the year 2021 following the passage of the American Rescue Plan Act of 2021 it was temporarily raised to 3600 per child.

A recent study published by the Urban Institute shows that if the child tax credit is extended beyond 2021 it could substantially reduce child poverty in the vast majority of US states. For 2021 eligible parents or guardians can receive up to 3600 for each child who was under 6 years old at the end of 2021 and up to 3000 for each child who was between the ages of 6 and 17. Families who received monthly payments in the second half of last year can still get up to 1800 for children younger than 6 and 1500.

Get your advance payments total and number of qualifying children in your online account. When Congress expanded the Child Tax Credit in the American Rescue Plan Act it made several changes that have helped low-income renters. Child Tax Credit 2021-2022 Explained and What It Means for Your Taxes.

Millions of American families benefited from the extended Child Tax Credit of 2021. Written by a TurboTax Expert Reviewed by a TurboTax CPA. The Joint Committee on Taxation estimated that the expansion would cost 105 billion between 2021 and 2022.

However the 2021 American Rescue Plan expanded this credit in. In 2021 President Joe Biden enacted the American Rescue Plan Act ARP which expanded the Child Tax Credit CTC significantly for one year making it the largest US. In 2021 this tax credit was increased.

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. The benefit was increased to 3000 from 2000 for children ages 6 to 17 with an additional 600. This year the existing child tax credit was expanded to include more children than ever before.

To reconcile advance payments on your 2021 return. Theres good news for American families. The last advance child tax credit payment of 2021 is being distributed VIDEO 827 0827 How a 31-year-old US.

Child tax credit ever and. January 28th 2021 1305 EST. Families can receive a 3600 tax credit for each child under age 6 and 3000.

Ad Get Your Maximum Refund Guaranteed Even If Youve Received The Advance Child Tax Credit. From 2023-2026 the cost of the child tax credit would be between 710 million and 725. If youre eligible you could receive part of the credit in 2021 through advance payments of up to.

The advance is 50 of your child tax credit with the rest claimed on next years return. Get the up-to-date data and facts from USAFacts a nonpartisan source. Last year its maximum value increased to 3600 for children under.

The Child Tax Credit provides monthly payments to families even those who do not file taxes or earn an income. Frequently asked questions about the 2021 Child Tax Credit and Advance Child Tax Credit Payments Topic C. CPA and TurboTax tax expert Lisa Greene-Lewis is here to explain how this credit can impact your tax situation.

Ad The new advance Child Tax Credit is based on your previously filed tax return. Join The Millions Who File Smarter And Get Your Taxes Done Right Guaranteed. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive.

Parents income matters too. A childs age determines the amount. Of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax Credit.

These updated FAQs were released to the public in Fact Sheet 2022-29PDF May 20 2022. Navy dentist making 157000 a year spends her money. Determine if you are eligible and how to get paid.

Originally it offered taxpayers a tax credit of up to 2000 for each qualifying dependent.

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Dependent Children 2021 Tax Credit Jnba Financial Advisors

If You Got The Child Tax Credit In 2021 You May Pay In 2022 Wsj

Nikhita Airi On Twitter Removing The Ctc Phase In Results In Average Benefits Increasing The Most For Families In The Lowest Income Quintile Under 25 000 Https T Co 9zw609d6yw Twitter

Child Tax Credit Could Spur 1 5 Million Parents To Leave The Workforce Study Says Cbs News

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

The Anti Poverty Targeting And Labor Supply Effects Of The Proposed Child Tax Credit Expansion Bfi

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Child Tax Credit Definition Taxedu Tax Foundation

Child Tax Credit Definition Taxedu Tax Foundation

2021 Expanded Child Tax Credit Who Qualifies Payment Schedule More Tele Haiti Tele Haiti First Tv Network Home Television News Guerre En Ukraine Telehaiti Nouvelles Actualites

How The 2021 Child Tax Credits Work Updated June 21st 2021 The Learning Experience

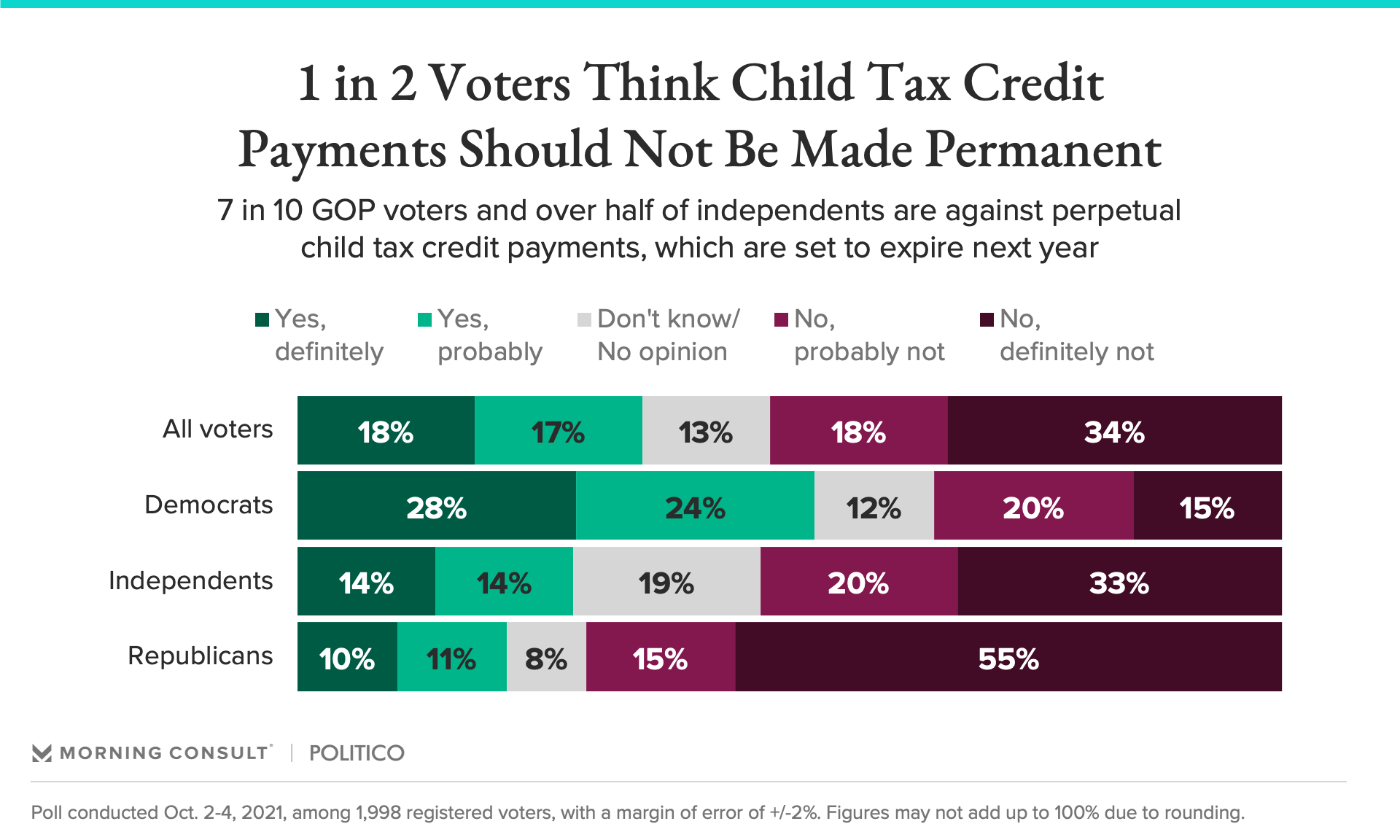

Who Gets Credit For The Expanded Child Tax Credits For Voters Across Parties Democrats And Biden Take The Prize

What To Know About The New Monthly Child Tax Credit Payments

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Here S Who Qualifies For The New 3 000 Child Tax Credit

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep